south dakota sales tax on vehicles

99-Applicant surrenders out- of-state title in applicants name from a state. The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales.

Motor Vehicle South Dakota Department Of Revenue

First multiply the price of the car by 4.

. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Municipalities may impose a general municipal sales tax rate of up to 2. Several examples of of items that exempt from South.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. What is South Dakotas Sales Tax Rate. All car sales in South Dakota are subject to the 4 statewide sales tax.

Review and renew your vehicle registrationdecals and license plates. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. They may also impose a 1 municipal gross.

45 What is the South Dakota sales tax rate. The South Dakota State Tax Tables for 2023 displayed on this page are provided in support of the 2023 US Tax Calculator and the dedicated 2023 South Dakota State Tax CalculatorWe also. Prices must be substantiated with a bill of saleof a debt.

Mobile Manufactured homes are subject to the 4 initial. While South Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. In addition for a car purchased in South Dakota there are other applicable fees including registration title and.

Do you have to live in South Dakota to register a Car. Motor vehicles registered in the state of south dakota are subject to the 4 motor vehicle excise tax. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

Different areas have varying additional sales taxes as well. The vehicle is exempt from motor vehicle excise tax under. The South Dakota sales tax and use tax rates are 45.

Our online services allow you to. In addition to taxes car purchases in south dakota may be subject to other fees like registration title and plate fees. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

To calculate the sales tax on a car in South Dakota use this easy formula. Its what is known as an open registration state. This page describes the taxability of.

South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. The South Dakota Department of Revenue administers these taxes. What is South Dakota Sales Tax.

Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. 5 North Dakota levies. When it comes to vehicle licensing.

It is not intended to answer all questions that may arise. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. What is ND sales tax on vehicles.

South Dakota sales tax and use tax rates are 45. The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax. The SD sales tax applicable to the sale of cars.

Motor Vehicle Sales The purpose of this Tax Fact is to explain how South Dakota state and local taxes apply to motor vehicle dealers. Purchased has lesser value than the vehicleboat traded. South Dakota law also requires any business without a physical presence in South Dakota to.

That is the amount you will need to pay in sales tax on your. The Motor Vehicle Division provides and maintains your motor vehicle records. The highest sales tax is in Roslyn with a.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and. South dakota excise tax on vehicles. All vehicles purchased in South Dakota are subject to a 4 motor vehicle excise tax while mobile and manufactured homes are taxed at 4 of the initial registration fee.

States With The Highest Lowest Tax Rates

South Dakota Taxes Business Costs South Dakota

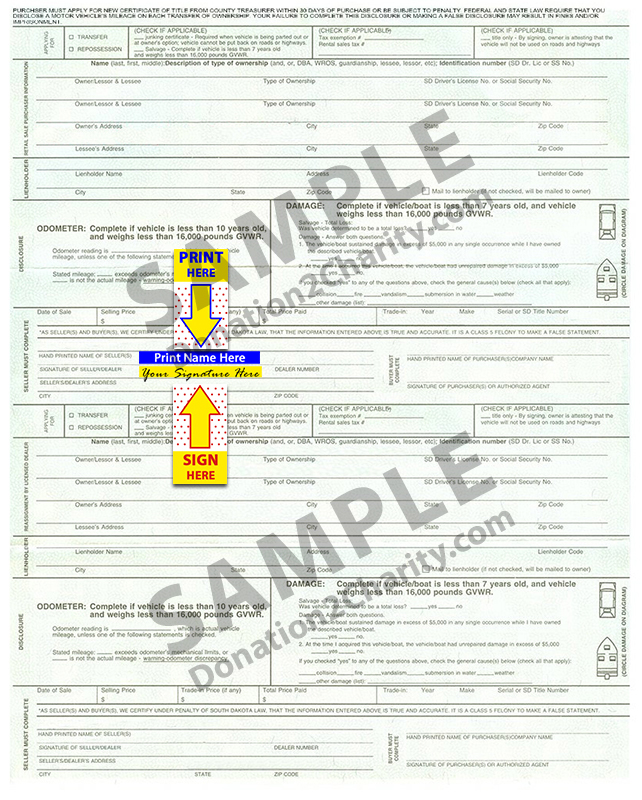

South Dakota Title Transfer How To Sell A Car In South Dakota Quick

South Dakota Department Of Revenue Pierre Sd Facebook

What Transactions Are Subject To The Sales Tax In North Dakota

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal

License Requirements For Sales Use Amp Contractors Excise Tax

Government Of South Dakota Wikipedia

South Dakota Department Of Revenue Facebook

Nj Car Sales Tax Everything You Need To Know

Are There Any States With No Property Tax In 2022 Free Investor Guide

How To Secure The Lowest Tax Rates On Your Next Car Carvana Blog

How To File And Pay Sales Tax In South Dakota Taxvalet

States With No Sales Tax On Rvs And What To Know About Them

Car Tax By State Usa Manual Car Sales Tax Calculator

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)